Beware Greeks voting for gifts

Greece’s election

Beware Greeks voting for gifts

Syriza’s success increases the risk of “Grexit” and will embolden anti-austerity parties across Europe

“WE HAVE finally put behind us the vicious cycle of fear and austerity.” So declared Alexis Tsipras, Greece’s new prime minister, to crowds cheering his party’s election victory on January 25th. Up to then, countries on the edge of the euro zone, forced to embrace harsh budget cuts and pledges of reform as the price for their bail-outs between 2010 and 2013, had—surprisingly—accepted the nasty medicine without a big populist revolt. That changed when Syriza, a radical far-left party led by Mr Tsipras, won power after campaigning to cast aside austerity, backtrack on reforms and insist that Greece’s vast debt is slashed.

These promises may have won votes for Syriza, but they have given investors the jitters. The stockmarket swooned—led by Greek banks, which suffered their biggest one-day drop ever on January 28th—and short-term bond yields jumped. Syriza’s pledges are also unacceptable to other European governments, whose already sulky voters resent stumping up any more for Greece. The one that matters most is Germany. The country’s chancellor, Angela Merkel, will be wary of any concessions that might encourage insurrectionist parties elsewhere in Europe.

So will one side give way? Or could the clash lead to the result from which both Greece and its euro-zone partners recoiled in 2012: “Grexit” from the euro, with painful consequences all round? Mr Tsipras insists that his country will stay in the euro, a policy backed by three-quarters of the Greek public. He has softened the hostile stance he took in the 2012 election, when Syriza campaigned to tear up the “memorandum”, the conditions set by Greece’s creditors for its two huge bail-outs, amounting to €246 billion ($278 billion) in all and policed by the “troika” of the European Commission, the IMF and the European Central Bank (ECB).

If that calmed nerves in Brussels and Berlin, his first steps as prime minister will have frayed them again. After coming close to winning an outright majority in the Greek Parliament, with 149 seats out of 300 (see chart 1), Mr Tsipras alarmed creditors by choosing as his coalition partner the Independent Democrats, a far-right party led by Panos Kammenos, which stridently supports Syriza’s line on debt relief and an end to austerity.

His first public act as prime minister was to visit a memorial for 200 Greeks killed by the Nazis in 1944: a gesture wreathed in symbolism for a man who rails against the German-led “occupation” of his country. Soon afterwards, he objected loudly to a supposedly unanimous EU statement criticising Russia’s renewed aggression in Ukraine.

A colourful team of ministers hardly suggests that compromise is on the cards. Yanis Varoufakis, appointed as finance minister, is an economist and blogger who has protested against “the fiscal waterboarding policies that have turned Greece into a debt colony”. Mr Varoufakis honed his skills as an academic, but also once worked as a consultant for a computer-games firm. Panagiotis Lafazanis, a Marxist who heads Syriza’s far-left faction, will run a ministry incorporating energy and the environment. At least George Stathakis, the new minister for the economy together with tourism, transport and shipping, the country’s biggest industries, is an expert on Greece’s first big bail-out, the Marshall plan of 1948.

Cleaning up Greece

Mr Tsipras has a mandate from the voters—though Syriza’s 36% share of the vote was hardly a landslide—that empowers him to make changes. But how much room for manoeuvre does he have?

In some respects the country is less vulnerable than it was in the summer of 2012, when it teetered on the brink of falling out of the monetary union. The economy is in better shape. A lingering recession ended last year. Growth of 0.7% in the third quarter of 2014 put Greece among the best performers in the euro zone. The country can now boast a small current-account surplus, a massive turnaround from 2008. The public finances are healthier than in 2012, thanks to the same austerity that Mr Tsipras so abhors. Furthermore, despite Greece’s extraordinarily high public debt, worth some 175% of GDP last year, successive concessions have eased its debt-servicing charges to such an extent that annual cash interest payments are now only 3% of GDP.

Regardless of these improvements, the Greek economy and public finances remain fragile. For the first time since 2012 bank deposits are being run down, by €3 billion in December and reportedly by up to €11 billion this month. The uncertainty is also harming tax revenues, which were much lower than expected in December. It is against this background that Mr Tsipras has pledged to launch a welfare package worth €2 billion to end what he calls Greece’s humanitarian crisis; to rehire 12,000 sacked civil servants; and to freeze privatisations. A crackdown on tax evasion by the wealthy and ending the grip on state procurement of Greece’s “oligarchs”, who control media outlets and parts of the judiciary, are unlikely to do enough to pay for Mr Tsipras’s largesse.

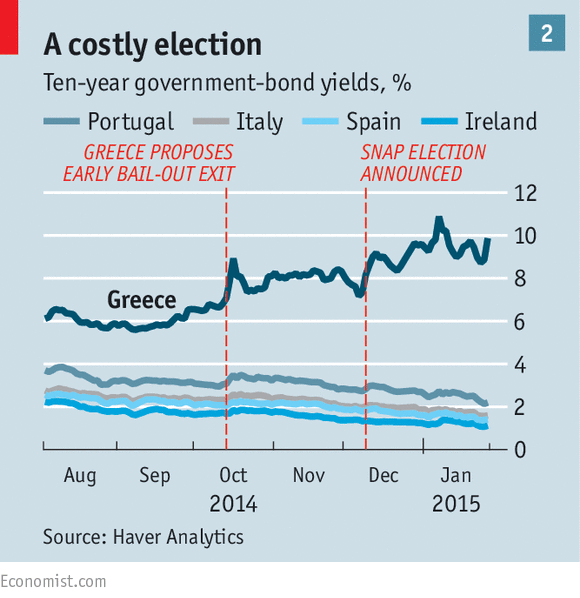

Syriza and its supporters may rail against the terms of their bail-outs, but Greece remains dependent on official support. Its debt is rated as junk. Bond yields fell sharply in the first half of 2014; but as political worries came to the fore towards the end of last year, yields jumped back to unaffordable levels (see chart 2).

Financial health-check

Even before Syriza’s victory, Greece and its creditors were at loggerheads, with the troika wanting more cuts in the 2015 budget and dissatisfied with the government’s failure to push through enough reforms. That caused a suspension of payments until the latest review of Greek performance in complying with the bail-out terms was completed. As a result, the European bail-out, which was due to end last year, has been extended until the end of February. The IMF’s portion of the rescue is scheduled to run until early 2016.

Without a successful conclusion of the review, Greece will be denied the final tranche of European loans of €1.8 billion, as well as a further €1.7 billion that this would trigger through another form of help, in which profits on the ECB’s holdings of Greek bonds are routed back to Greece. A successful deal would also release a further €3.5 billion from the IMF. In all, Greece could lose €7 billion, together with commitments of an additional €13 billion from the IMF by early 2016.

That would be disastrous, since Greece has some substantial payments to make over the next few months. To avoid default, Greece must honour repayments of its first bail-out loans from the IMF, together with redemptions of other bonds that are due. The IMF is due to get €2.5 billion in the first quarter of 2015 and the same again in the second quarter. The Greek government must also repay to the ECB €6.7 billion in July and August for sovereign bonds that the central bank bought when trying to quell market panic after Greece’s first bail-out, in May 2010. Although the government apparently has €10 billion stashed away in public-sector reserves, getting at these quickly will be difficult. And even if it is possible, making the payments to the IMF and the ECB could push Greece to the limit—especially if the tax take continues to fall short.

This puts Mr Tsipras under a lot of pressure to agree upon an extension of the current EU bail-out programme. The EU would have no objection to that. Having to ask—a condition set by Brussels—would mean an embarrassing about-turn for the new prime minister; yet he does not have much choice. Germany and the IMF have made it clear that debt relief cannot be discussed unless Greece completes the review, stays on track with fiscal targets and carries out more structural reforms.

Even if the bail-out programme were extended, that would not resolve the dispute between Mr Tsipras and the rest of Europe. The quarrel might mean that the ECB takes a tougher line with Greek banks. At present it is prepared to lend to them on the same terms as other euro-zone banks. But if Mr Tsipras is too provocative, the ECB will insist that funding is “emergency liquidity assistance” at the Bank of Greece’s risk rather than that of all euro-area central banks. Besides sending a message to the Greek government, it would raise the cost of the banks’ borrowing. The ECB could take such a decision in the next few days if Mr Tsipras sends it the wrong signals.

Just days after the celebrations among Syriza supporters in the wake of their election triumph, the mood in Athens is edgy. If depositors panic and banks wobble, that could lead to a crisis that might end either with Grexit or in a humiliating climb-down that spells an early end for the new government—as well as political chaos.

Avoiding a collapse of the banks is merely the first task for Mr Tsipras. If he gives in to the demands of the troika, Syriza’s fractious far-left wing, the Left Platform, is bound to rebel. This group of Maoists, Marxists and supporters of Che Guevara controls about a third of the party. Hungry for power, the Left Platform dropped its ideological objections to co-operating with Mr Kammenos’s party in return for Mr Lafazanis getting his cabinet post. An angry or disappointed Mr Lafazanis could split the party and bring down Mr Tsipras’s government.

Writing off a write-off

Even if Mr Tsipras wants to make peace with Greece’s creditors, an accident may happen along the way. His government is frighteningly inexperienced for the size of the task it must undertake. The dangers of sounding unnecessarily aggressive or acting hastily are magnified by the delicate negotiations it faces. Only one cabinet member, Giannis Dragasakis, a former central-committee member of the Greek communist party, has ever served in government before.

European creditors can make a few limited concessions. Debt forgiveness—writing off some official debt—has been ruled out. But it would be possible to relieve the debt burden by further extending the maturities on the loans, although these have already been stretched to an average of 30 or so years. On the other hand, the German government will object to any let-up in Greece’s own effort to bring down the debt burden, which involves running a sustained primary (ie, before interest) budget surplus of more than 4% of GDP from 2016. And it is just as concerned to prevent Mr Tsipras rowing back on reforms that are seen as indispensable if Greece is to pay its way and not rely on more transfers.

If Mr Tsipras pushes his luck, creditors are likely to push back equally firmly, insisting that failure to abide by their terms would mean Greece being expelled from the monetary union. The German government came close to taking this decision in 2012, but pulled back; Mrs Merkel was worried about the wider consequences for the euro zone. However, officials in Berlin reckon that the risk of financial and economic contagion is now lower.

The euro area now has a permanent rescue fund. And with the ECB launching its big programme of quantitative easing in March, creating money to buy sovereign bonds and other assets, a flare-up in the bond markets of other peripheral countries seems less likely. There has so far been little sign of contagion from Greece to the rest of southern Europe. The political risks for Mrs Merkel are also lower, because it would be Mr Tsipras who would be blamed rather than her.

That calculation may yet be proved wrong. Grexit would breach the principle that euro membership is irrevocable, making investors worry about other countries that might be forced out. But whatever the wider impact, the consequences for Greece would be traumatic. Overnight, euros would become a foreign currency as the government converted domestic assets and liabilities into drachmas. A new Greek currency would immediately plummet in value. The IMF reckoned nearly three years ago that it would fall by 50%; some economists thought it would fall by even more.

Such a depreciation would restore Greek competitiveness with a bang, helping to lure tourists and boost exports. But it would also trigger inflation, as prices of imports shot up. More important, currency depreciation would make Greece’s foreign debts, which would remain in euros, unsustainable. That would cause the country to default, which could lock it out of global capital markets for years.

The shock of Grexit would hit the economy hard. The IMF estimated in early 2012 that, in the first year, it could depress GDP (which was already falling sharply) by an additional eight percentage points. The impact now might be less severe, but Greece would still lurch from its recovery into a renewed and sharp recession. The longer-term benefits from regained competitiveness might also be lost if it were forced to leave the EU and the single market as well as the euro, as a widely cited legal paper from the ECB maintains.

Even if Grexit is only halfway as ruinous as these projections suggest, Mr Tsipras should be wary about provoking such an outcome, especially as Greeks want to remain in the euro. This suggests that, despite a bigger-than-expected election victory, his bargaining position is weak. The task for European governments is to find a way for him to retreat from his demands without losing face altogether.

His war-memorial visit and complaint about the official statement on Russia are dismissed by officials in Brussels as gestures for domestic consumption. A meeting of EU heads of government on February 12th, Mr Tsipras’s first, may be more revealing. What can he achieve? On paper he has little leverage. And he has aroused high expectations among voters and his fractious party.

Discussions with Brussels are only part of the story. Any bail-out extension must be approved by parliaments in Germany, Finland, the Netherlands and Estonia: four countries not renowned for their forbearance towards fiscal sinners. The attitudes of such hardline governments will matter at least as much as those of EU institutions.

The Finnish government, which in 2011 refused to back Greece’s second bail-out until it was offered collateral, has every reason to be tough: it faces a difficult election in April, and there are few votes to be won by being nice to Greeks. Similarly, the Dutch government must contend with the threat of Geert Wilders’s populist Party for Freedom, which has lately been leading the opinion polls.

Yet the crucial country is Germany. Politicians in Mrs Merkel’s ruling coalition have couched their intransigence in appeals to the sanctity of rules. Steffen Seibert, her spokesman, insists that the new Greek government must meet the commitments made by the outgoing one. Wolfgang Schäuble, Germany’s finance minister and a stern advocate of fiscal probity, declared both that he respected the outcome of Greece’s election and that the new government must respect the “obligations” to which its predecessor had signed up.

The talk is tough at the centre of German politics. Any hint of softness towards Greece might increase the appeal of the political fringes. The Left, a party that descends from the Communists who once ruled East Germany and that sees Syriza as an ideological ally, cheered what it hoped was the start of an uprising against Mrs Merkel’s policies. On the populist right the Alternative for Germany, a party founded in 2013 with a call to dissolve the euro, also celebrated, believing that the Greek election would bring its goal closer. Its leader, Bernd Lucke, suggested that Greece should leave the single currency at once.

Heading for the Grexit?

Earlier this month, Mrs Merkel’s government let it be known that it now sees Grexit as “bearable” for the rest of the euro. She prefers to keep Greece in the single currency, and may be willing to yield to Mr Tsipras just enough to let him declare victory at home—for instance, by extending the maturities of existing Greek debt. But she is unlikely to go further. The prospects of cutting Greek debt by up to half, as Mr Tsipras has demanded, appear remote. Giving handouts to governments that throw tantrums, runs the argument, makes it harder to maintain pressure on larger countries in need of reform, such as France and Italy.

As ever, the looming Greek crisis is about far more than Greece. Going soft on Greece may also embolden Syriza-like parties in other countries (see article). In Spain Podemos, a party that emerged from nowhere to lead the polls, has closely allied itself with Syriza. Its leader, Pablo Iglesias, singles out Mrs Merkel, with her ruthless demands for austerity, as the foe of Europe’s downtrodden. It is perhaps no coincidence that ministers from Spain and Portugal, both run by centre-right governments facing anti-austerity challenges in elections this year, were among the first to warn of the dangers of dancing to Syriza’s tune after the election.

In this context, German lawmakers are unlikely to look upon Greek demands with sympathy. But many Europeans want to change the conversation: under its new president, Jean-Claude Juncker, the European Commission has, for example, been battling to win support for an ingeniously engineered pan-European investment package. The French and Italian governments, in danger of incurring the EU’s wrath over their fiscal stances, are similarly keen to leave the austerity years behind.

Until now, Europe’s fiscal squabbles have rarely amounted to more than a phoney war. Politicians such as Antonis Samaras, the man Mr Tsipras replaces, who denounced austerity as opposition leaders, found themselves signing up to it once they were in office. The election of François Hollande as France’s president in 2012 was supposed to tilt Europe in a more growth-friendly direction, but the country’s structural weaknesses and his own missteps have weakened his hand. Germany was never short of noisy critics, but none of them held office. With Mr Tsipras’s election, that is no longer the case.

Comments