GreeceEurozone crisis live

Greece election: Syriza forms coalition with Independent Greeks – live updates

Rolling reaction to Syriza’s historic success in the Greek elections, which opens up a new chapter in Europe’s debt crisis

- Latest: Independent Greeks to form coalition with Syriza

- Syriza MP: We’ve won a poisoned chalice

- Greek stock market slides, bond yields jump

- Greek elections: The Results

- Osborne: It’s not a rejection of austerity

- Share your perspectives via GuardianWitness

Updated

Parliamentary mathematics time: the new government will have a working majority of 162 seats in the 300-seat parliament (Syriza’s 149 MPs plus the Independent Greeks with 13).

— Alex Andreou (@sturdyAlex)January 26, 2015BREAKING: Coalition announced, as expected, between SYRIZA and ANEL (Independents with 13 MPs, giving a majority of 162).

The coalition deal means that Tsipras can now be summoned to the Greek presidential palace to be given a mandate to form a government.

We’ll then get details of his cabinet ministers.

So, Tsipras has managed his first task - agreeing a coalition between his radical left-wing Syriza and the populist right-wing Independent Greeks.

The hard work starts here, though, as veteran conservative MP and former health minister Antonis Georgiadis explains.

Georgiadis just told Skai News that “And now the difficulties begin”, adding.

“The [economic] evaluation has to be concluded as soon as possible. It’s not a matter of months or weeks but days! I very much hope that Alexis and Panos [the government’s two new leaders] can save Greece.”

With both at the helm of government his greatest fear is that the country would ultimately turn to the extreme right, if the coalition fails.

Golden Dawn, which pulled off the stunning fear of emerging as the third biggest political force in Sunday’s poll, is waiting …. eagerly, Helena Smithexplains.

Updated

GREECE HAS A GOVERNMENT

It’s official: Greece has a government - a coalition between Syriza and the Independent Greeks.

Less than an hour after talks began, Panos Kommenos, leader of the Independent Greeks party has emerged from Syriza’s party HQ saying the country has a new government.

Helena Smith reports that Kommenos said:

“I want to say, simply, that from this moment, there is a government.” “The Independent Greeks [party] will give a vote of confidence to the prime minister Alexis Tsipras.“The prime minister will go to the president and … the cabinet make-up will be announced by the prime minister. The aim for all Greeks is to embark on a new day, with full sovereignty.”

Updated

Alexis Tsipras must achieve “deep structural and institutional change” in Greece before trying to get a debt deal out of Brussels.

So argues Greek journalist Nick Malkoutzis this morning. He reckons that Syriza’s top priority should be to reform the justice system, the civil service, the tax-collection operations, to show eurozone allies he is serious.

Writing on MacroPolis, Malkoutzis writes:

If SYRIZA really wants to seize the opportunity it has been given then the best service it can offer to Greece is to deal with the deep-rooted malaise in the public administration and political system.This will offer Greece a sounder platform for the future than a reduction in the public debt or a faster rate of growth. In fact, securing the last two without the first will only lead to Greece ending up in the same place it is now sooner or later.

German newspapers react

There’s a mixed reaction in German newspapers to radical leftist Alexis Tsipras’s triumph.

My colleague Louise Osborne has scoured the pages, and reports:

Germany’s biggest newspaper Bild leads with the headline, “Greeks vote for the Euro-fright”, writing that Alexis Tsipras achieved a “landslide victory”.

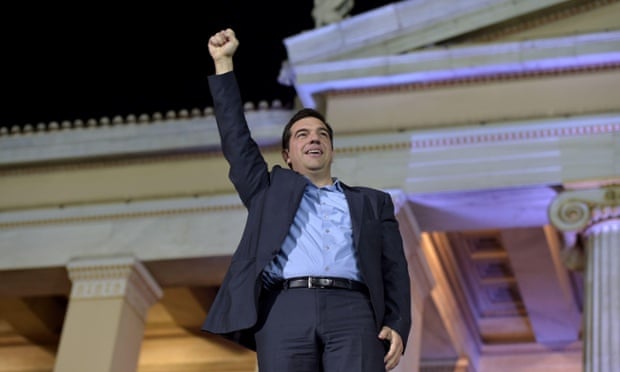

The paper goes on to ask, “What will the winner’s fist cost us?” accompanied by a picture of Tsipras punching the air following the news of his victory.

A Bild comment piece also predicts that Tsipras will make his goals clear today; an end to the reforms and more help for Greece. Germany must resist, Bild argues:

“Sorry, Mr Tsipras, but that’s going too far! The Eurozone is no gambling den in which every gambler can do what he wants. And where once closed agreements can be questioned at one’s own pleasure. What applies here is: An agreement is an agreement!”

Meanwhile, Germany’s left-leaning newspaper die Tageszeitung says the result brings both “opportunities and risks”.

It writes:

“The victory of Syriza is a chance for Greece to free itself from the decades of corruption and nepotism, with which both the conservative New Democracy and the social democratic Pasok were inextricably bound,”

It adds, however, that Tsipras has produced “insatiable hopes” and will have to make it clear that Syriza cannot avoid entering into negotiations with European lenders, otherwise Greece could be insolvent in a few months and without much-needed social improvements.

Are you one of Greece’s 9.8 million voters? After the historic win by Syriza, we’d like to hear your hopes and fears for the future of the country.

Updated

Dimitris Vitsas, a member of Syriza’s central committee has just told SKAI TV that “our immediate and most pressing priority is to alleviate the humanitarian crisis.”

“The Greek people have cancelled the policies of the memorandum,” he said referring to the deeply unpopular bailout accords outlining the onerous conditions of EU-IMF aid to debt-stricken Greece.

Vitsas, Syriza’s chief policy chief, added:

“We don’t want a rupture [in relations] with Europe … disagreement is one thing, rupture quite another.”Despite all the forecasts of economic catastrophe with the advent to power of a left-wing government “we have woken up to a sunny day.”.“The banks haven’t closed, they are operating normally, schools are open. Everything is just as it should be.”

(via Helena Smith)

Greek bonds have also fallen in value this morning.

That has pushed up the yield, or interest rate, on Greece’s 10-year bonds trading in the markets to 8.96% this morning, up from 8.74% on Friday.

That’s deep into the ‘danger zone’ where a country cannot borrow from international investors.

Greek stock market drops 5%

Greek bank shares have slumped in volatile early trading in Athens.

The ATG stock index has tumbled by over 5%, as investors raced to offload stocks following Syriza’s success.

Financial stocks led the selloff, reflecting fears that Athens could now become locked in a battle with Europe over debt relief. guardian

Comments