Few economic surprises after EU elections

Few economic surprises after EU elections

Euroskeptic parties gained ground in elections for the European parliament on Sunday. But economists expect little change, and when it comes to financial markets, investors say there's no reason to panic.

The euro barely showed any reaction at all to the outcome of the elections for the EU parliament. At 1.36, the exchange rate for the dollar was almost the same on Monday morning as it was on Friday - two days before the polls.

In fact, most markets opened the week with their Friday rates. In Frankfurt, Germany's Dax closed with a new record high on Friday and opened with further gains on Monday. EuroStoxx 50, a stock index for the eurozone, also ran higher by almost one percent.

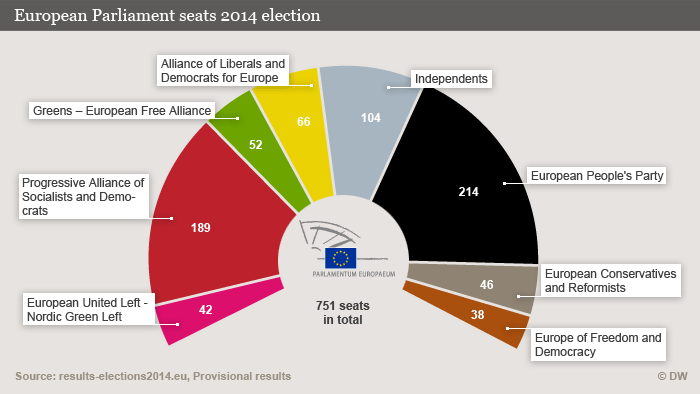

Euroskeptic parties won almost one out of five seats in the new EU parliament: about 140 of the chamber's 751 deputies. The backlash was particularly strong in France and Britain. In France, the second largest economy in the eurozone after Germany, the party emerged on top with around 25 percent of the vote.

No reason to panic

"This is a shock, an earthquake," said the French Prime Minister Manuel Valls, adding, "A terrible moment for France and Europe."

In Britain, the anti-EU UK Independence Party (UKIP) triumphed. And in Greece, the far-left alliance Syriza, which also opposes the European Union, placed first in the poll.

Still, investors in the financial markets say there is no need to panic. Ultimately, two thirds of the seats in the European parliament will be filled by representatives of the established parties, namely the Conservatives and the Social Democrats.

"Therefore the pro-European course in Strasbourg isn't at risk," said economist Thomas Gitzel, with the Liechtenstein-based VP Bank.

For Ferdinand Fichtner, economics expert at the German Institute for Economic Research in Berlin, the election result is a sign of continuity.

"The result is favorable for the German and the European economies," Fichtner told DW. "You can be rest assured that the integration process and the institutional restructuring of the monetary union will continue."

The experts say the new political landscape will also contribute to improved confidence in business and in the financial markets.

Business as usual?

"The election result will change little in the short to medium term," writes Christoph Weil in an election analysis for Commerzbank. But he is skeptical about the potential long term effects. The results show "a deep mistrust for European institutions among the population," writes Weil. The implication being that it will now be even more difficult "to push ahead with the political union that's necessary to ensure the long term survival of the euro."

"Of course the euroskeptic parties will try to sabotage the eurozone," said Robert Halver, a capital market analyst with Baader investment bank. However, the "counter-movement" of the two-thirds majority, made up of the established parties, is stronger.

The salvation of the euro will therefore remain unchanged, says Halver. "The parliament will become an institution to push through Mario Draghi's monetary policy offensives." Earlier in May, the head of the European Central Bank announced plans to further ease monetary policy.

Martin Wansleben, managing director of the German Chamber of Commerce and Industry, warns that the strong euroskeptic signals to emerge from the election shouldn't be overlooked. "There's no 'business as usual.' The bureaucracy will have to change," he said.

He hopes the election results will help drive new momentum. "We are counting on Europe to look closely at stronger competitiveness and fewer bureaucratic rules," he said.

Comments