Greece debt crisis: 'Last-minute deal sought'

Greece debt crisis: 'Last-minute deal sought'

- 11 minutes ago

- Europe

The Greek government is reportedly planning to request a new two-year bailout deal from the eurozone.

It comes just hours ahead of a deadline to repay €1.6bn (£1.1bn) to the International Monetary Fund (IMF).

Reports of the move to call for aid from the European Stability Mechanism emerged as Greek leaders held talks over the European Commission's latest proposal for Greek economic reforms.

If Athens accepts the EC deal, it will free up cash to repay the €1.6bn.

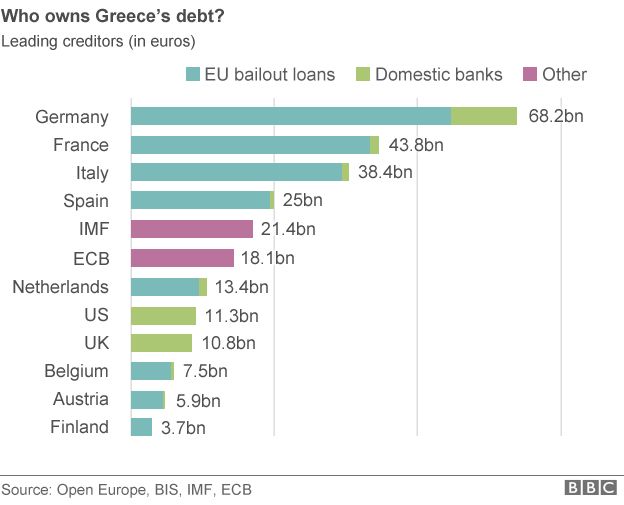

Amid fears of a Greek default on its huge public debt of €323bn - and a possible exit from the euro - long queues of people are continuing to snake from many cash machines in Greece, where withdrawals are capped at just €60 a day.

Greek banks were shut this week after talks between Greece and its creditors broke down.

However, up to 1,000 bank branches will re-open from Wednesday to allow pensioners - many of whom do not use bank cards - to withdraw up to €120.

A European Commission spokesman said the commission's president, Jean-Claude Juncker, was called by Greek Prime Minister Alexis Tsipras on Monday night.

The European Commission says the deal offered by Mr Juncker on Monday was identical to one made on Friday.

However, reports in Greece say the new offer is different to Friday's, and includes a change in terms to Ekas - a top-up given to poorer Greek pensioners.

Athens does not want it scrapped before 2020, but Europe wants it phased out earlier.

European Commission spokesman Margaritis Schinas said: "There may be still margins or not for further discussions."

Resignation hint

A referendum is due to take place in Greece on Sunday over whether the country should accept the creditors' proposals.

EU leaders have warned that a rejection of the proposals would mean Greece leaving the eurozone - though Mr Tsipras says he does not want this to happen.

The EC says that if funds were to be released, Mr Tsipras and his party must back the "yes" vote in the referendum.

What will happen next?

01:00 Greek time Wednesday (22:00 GMT): Greece's €1.6bn repayment to the IMF is due.

5 July - the referendum on creditors' proposals, and many say Greece's membership of the eurozone, takes place

20 July - Greece must redeem €3.46bn of bonds held by the European Central Bank. If it fails to do so, the ECB can cut off Greece's access to emergency loans.

Speaking live on state TV on Monday evening, Mr Tsipras appealed to Greeks to reject the creditors' proposals, saying this would give Greece "more powerful weapons" to take to the negotiating table.

Mr Tsipras also hinted strongly that he would resign if the result of the referendum was a "yes" vote.

"If the Greek people want to proceed with austerity plans in perpetuity, which will leave us unable to lift our head... we will respect it, but we will not be the ones to carry it out," he said.

Some eurozone leaders, including the Italian prime minister and French president, voiced their concern on Monday that Greek voters would effectively be deciding next Sunday whether or not they wanted to stay in the eurozone.

Meanwhile, European Commission President Jean-Claude Juncker said he felt betrayed by the Tsipras-led government and called on Greek voters to oppose him.

The ECB is believed to have disbursed virtually all of its emergency funds for Greece, amounting to €89bn (£63bn).

Days of turmoil

- Friday evening: Greek prime minister calls referendum on terms of new bailout deal, asks for extension of existing bailout

- Saturday afternoon: Eurozone finance ministers refuse to extend existing bailout beyond Tuesday

- Saturday evening: Greek parliament backs referendum for 5 July

- Sunday afternoon: ECB says it is not increasing emergency assistance to Greece

- Sunday evening: Greek government says banks to be closed for the week and cash withdrawals restricted to €60

Comments