Turkish economic success falls victim to political turmoil AFP By Tanya Willmer 9 hours ago Turkey's Prime Minister Recep Tayyip Erdogan delivers a speech to parliament in Ankara on January 14, 2014. View gallery . . . Istanbul (AFP) - Turkey was once hailed as an economic success story, clambering out of a financial abyss with reforms over the past decade to near double-digit growth, a construction boom and improved prosperity. But today the picture is bleak, overshadowed by an escalating political crisis that threatens Prime Minister Recep Tayyip Erdogan's own future and the country's hard-won economic gains. The turmoil has seen stocks plunge and sent the lira tumbling to record lows, casting doubt on government goals of reining in inflation and sparking warnings of stagnation in the emerging economy. Analysts say the lira could yet fall further, with Turkey also at risk of a credit crunch as its yawning current account deficit makes it vulnerable to outside forces, particularly the US tapering of its massive monetary stimulus. "Combine this with political risk: corruption scandals, accusations of a potential coup and fears that the government is trying to erode the independence of the judiciary have led to widespread protests, and the financial situation for Turkey could deteriorate fast," said Kathleen Brooks at online trading site Forex.com "It is no wonder that investor sentiment is negative on Turkey." The Istanbul share market has lost about 20 percent of its value over the past year, the lira has sunk to historic lows of 3.0 to the euro and 2.2 to the dollar and 10-year bond rates are above 10 percent -- higher even than in troubled Greece. View galleryProtesters in Ankara on January 11, 2014 hold a placard … Protesters in Ankara on January 11, 2014 hold a placard with a cartoon depicting Recep Tayyip Erdoga … Rivals 'want to taint Turkey's image abroad' The government, a model of stability for most of Erdogan's 11 years in power, has been rocked by a corruption scandal targeting key members of the premier's inner circle just six months after massive nationwide protests against his rule. The probe is looking into allegations of corruption by a state-owned bank and bribery in construction projects -- one of the booming sectors under Erdogan. It has badly tarnished the image of his Islamic-leaning Justice and Development Party, which took office pledging to wipe out endemic corruption and whose initials AK mean "purity" in Turkish. Erdogan -- seen as increasingly autocratic by opponents -- has retaliated by conducting mass purges in the police, moving to curb the powers of the judiciary and axing rivals from state institutions. The combative premier has lashed out at what he describes as a coup plot by followers of ally-turned-nemesis Fethullah Gulen, an exiled cleric who retains influence in key state apparatus. View galleryA board displays index levels at the Istanbul Stock … A board displays index levels at the Istanbul Stock Exchange in Istanbul, 30 April 2007 (AFP Photo/H … "That organisation and its allies in the media are trying to deal a heavy blow to economy, hike interest rates, scare foreign investors, saboutage energy policies, and taint Turkey's image abroad," Erdogan thundered this week. The crisis has raised concerns among economic analysts as much as rights groups and the EU about the threat to the rule of law and democracy. Deputy Prime Minister Ali Babac warned that Turkey's economic goals could be at risk "if we can't make an investor, whether domestic or international, take the view 'I trust the Turkish legal system'." Finance Minister Mehmet Simsek conceded that the US Fed policies and the political crisis could impact growth but insisted any slowdown would be temporary "because Turkey’s footing is firm". Officials are forecasting gross domestic product to expand by four percent this year, down from lofty rates near nine percent in 2010. Inflation is also projected to come down to 5.3 percent from 7.4 percent in 2013 -- still a far cry from the runaway rates of 3,000 percent at the peak of the financial crash in 2001. View galleryPolice use a water cannon to try to disperse people … Police use a water cannon to try to disperse people protesting on Istiklal Avenue in Istanbul, on Ja … Unemployment remains high at just under 10 percent but down from a 2009 peak of over 14 percent in the wake of the global financial crisis. 'Crisis dealt a blow to confidence' Inan Demir, chief economist at Finansbank, said the government's greatest achievements had been to sustain robust growth and more than triple per capita income. "However, this success was underpinned by the availability of cheap global liquidity and Turkey attracted substantial amounts of foreign capital, causing it to post sizeable current account deficits in the process," he said. He said the current account deficit, over 7.0 percent of GDP, posed the biggest risk to the economy right now. "The political crisis has already dealt a blow to (consumer) confidence," said Demir, a sentiment he said would likely be reflected in the postponement of spending decisions, particularly on big ticket items, and an increase in foreign currency deposits. Jittery Turks have already sharply increased their holdings of foreign currency by $20 billion over the past six months to $118 billion. Demir said the weaker currency could hit corporate investment plans and potentially "bring economic activity to a standstill and even lead to negative GDP growth if the exchange rate shock is large and sustained enough". London-based Capital Economics said improved governance had been a key ingredient in Turkey's economic success story, with strengthened banking regulations and fiscal policy as well as EU-demanded political reforms. "Worryingly, however, the AK party’s commitment to reforms has been waning in recent years," it said. If the government starts to backslide... the consequences could be even more severe." Financial markets are likely to be watching the central bank meeting on Tuesday for any moves on interest rates to shore up the currency. The bank sold $17.6 billion of foreign currency reserves last year to support the lira but has been reluctant to raise rates. But Brooks warned: "Turkey’s lists of problems are stacking up and there does not seem to be any solutions in sight, which could keep investors wary of the lira for some time."

Turkish economic success falls victim to political turmoil

Istanbul (AFP) - Turkey was once hailed as an economic success story, clambering out of a financial abyss with reforms over the past decade to near double-digit growth, a construction boom and improved prosperity.

But today the picture is bleak, overshadowed by an escalating political crisis that threatens Prime Minister Recep Tayyip Erdogan's own future and the country's hard-won economic gains.

The turmoil has seen stocks plunge and sent the lira tumbling to record lows, casting doubt on government goals of reining in inflation and sparking warnings of stagnation in the emerging economy.

Analysts say the lira could yet fall further, with Turkey also at risk of a credit crunch as its yawning current account deficit makes it vulnerable to outside forces, particularly the US tapering of its massive monetary stimulus.

"Combine this with political risk: corruption scandals, accusations of a potential coup and fears that the government is trying to erode the independence of the judiciary have led to widespread protests, and the financial situation for Turkey could deteriorate fast," said Kathleen Brooks at online trading site Forex.com

"It is no wonder that investor sentiment is negative on Turkey."

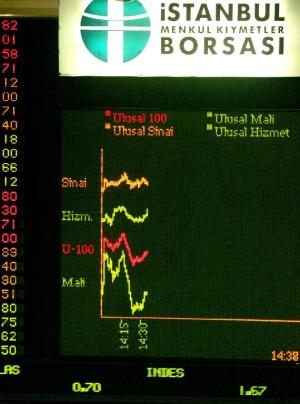

The Istanbul share market has lost about 20 percent of its value over the past year, the lira has sunk to historic lows of 3.0 to the euro and 2.2 to the dollar and 10-year bond rates are above 10 percent -- higher even than in troubled Greece.

Rivals 'want to taint Turkey's image abroad'

The government, a model of stability for most of Erdogan's 11 years in power, has been rocked by a corruption scandal targeting key members of the premier's inner circle just six months after massive nationwide protests against his rule.

The probe is looking into allegations of corruption by a state-owned bank and bribery in construction projects -- one of the booming sectors under Erdogan.

It has badly tarnished the image of his Islamic-leaning Justice and Development Party, which took office pledging to wipe out endemic corruption and whose initials AK mean "purity" in Turkish.

Erdogan -- seen as increasingly autocratic by opponents -- has retaliated by conducting mass purges in the police, moving to curb the powers of the judiciary and axing rivals from state institutions.

The combative premier has lashed out at what he describes as a coup plot by followers of ally-turned-nemesis Fethullah Gulen, an exiled cleric who retains influence in key state apparatus.

"That organisation and its allies in the media are trying to deal a heavy blow to economy, hike interest rates, scare foreign investors, saboutage energy policies, and taint Turkey's image abroad," Erdogan thundered this week.

The crisis has raised concerns among economic analysts as much as rights groups and the EU about the threat to the rule of law and democracy.

Deputy Prime Minister Ali Babac warned that Turkey's economic goals could be at risk "if we can't make an investor, whether domestic or international, take the view 'I trust the Turkish legal system'."

Finance Minister Mehmet Simsek conceded that the US Fed policies and the political crisis could impact growth but insisted any slowdown would be temporary "because Turkey’s footing is firm".

Officials are forecasting gross domestic product to expand by four percent this year, down from lofty rates near nine percent in 2010.

Inflation is also projected to come down to 5.3 percent from 7.4 percent in 2013 -- still a far cry from the runaway rates of 3,000 percent at the peak of the financial crash in 2001.

Unemployment remains high at just under 10 percent but down from a 2009 peak of over 14 percent in the wake of the global financial crisis.

'Crisis dealt a blow to confidence'

Inan Demir, chief economist at Finansbank, said the government's greatest achievements had been to sustain robust growth and more than triple per capita income.

"However, this success was underpinned by the availability of cheap global liquidity and Turkey attracted substantial amounts of foreign capital, causing it to post sizeable current account deficits in the process," he said.

He said the current account deficit, over 7.0 percent of GDP, posed the biggest risk to the economy right now.

"The political crisis has already dealt a blow to (consumer) confidence," said Demir, a sentiment he said would likely be reflected in the postponement of spending decisions, particularly on big ticket items, and an increase in foreign currency deposits.

Jittery Turks have already sharply increased their holdings of foreign currency by $20 billion over the past six months to $118 billion.

Demir said the weaker currency could hit corporate investment plans and potentially "bring economic activity to a standstill and even lead to negative GDP growth if the exchange rate shock is large and sustained enough".

London-based Capital Economics said improved governance had been a key ingredient in Turkey's economic success story, with strengthened banking regulations and fiscal policy as well as EU-demanded political reforms.

"Worryingly, however, the AK party’s commitment to reforms has been waning in recent years," it said. If the government starts to backslide... the consequences could be even more severe."

Financial markets are likely to be watching the central bank meeting on Tuesday for any moves on interest rates to shore up the currency.

The bank sold $17.6 billion of foreign currency reserves last year to support the lira but has been reluctant to raise rates.

But Brooks warned: "Turkey’s lists of problems are stacking up and there does not seem to be any solutions in sight, which could keep investors wary of the lira for some time."yahoo news

Comments